Are you looking to invest but don’t know where to start? Our complete guide to investing will help you. You will learn that you can start investing even with CZK 100 in your pocket. You will realise that building societies or pensions are not the best financial products. You start to look at money differently. But you will also find that there are many investment options and it is not easy to choose. But that’s what we’re here for. 😎 So how to invest?

Why invest

From our point of view, there are only two things that can be done with money. You can either spend it or invest it and let it earn money.

Going to work and making money is great, but spending it in the second breath is not so much. What if money could work for you even when you’re sleeping or enjoying free time with your family? This kind of income is called passive income.

💡 What is passive income read in our article .

By investing regularly in different instruments, you can build up a passive income over the years and live on it in old age.

Regular investing – cumulative effect

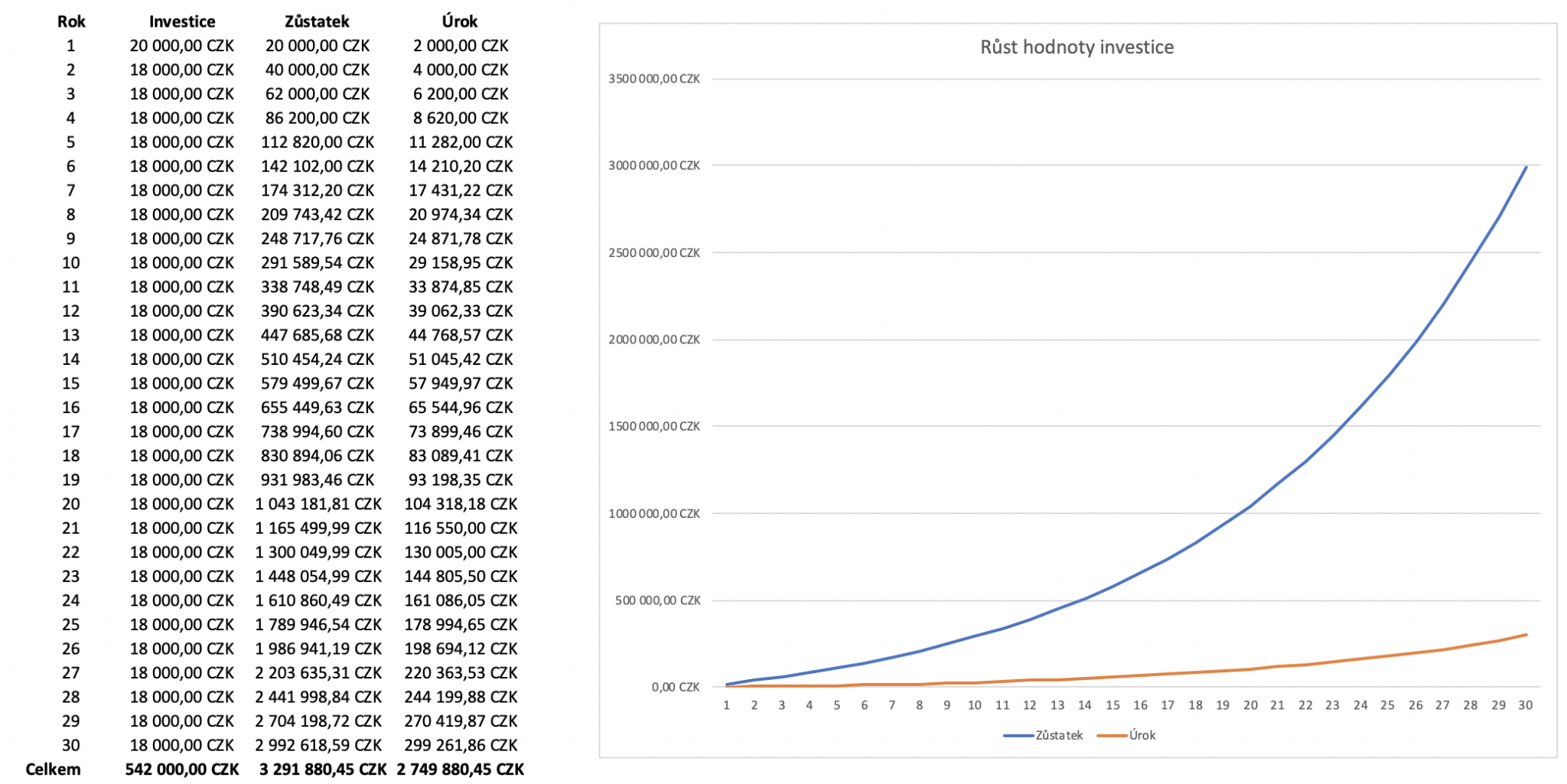

The biggest attraction of passive income is the cumulative effect that comes if you reinvest the interest earned (compound interest) and ideally invest more money on a regular basis. I attach a simple example of a long-term investment plan for 30 years. The example assumes that you maintain a net annual interest rate of 10% for 30 years.

- Initial deposit: 20 000 CZK

- Recurring monthly deposit: 1500 CZK

- Number of years: 30

- Net interest considered: 10%

- Invested: 542 000 CZK

- Earnings: 2 749 880 CZK

Fundamentals of investing

Investing is the process of putting money into various financial instruments such as stocks, bonds, mutual funds, real estate, and more, with the goal of earning a profit or appreciating your money. Investments can be short-term or long-term, and vary in the level of risk and how quickly you can eventually get rid of them.

Size of initial investment

Your base capital (how much money you want to invest at the beginning) largely determines what types of investments you will make. It makes a difference whether you start with 1,000 CZK or 1,000,000 CZK.

Investment horizon

How long do you want to invest for? Do you plan to invest regularly for the next 30 years, or have you come into extra money and want to save it somewhere for now? It will also largely drive your investment decisions.

Liquidity of the investment

Liquidity means how quickly you can get rid of the investment if necessary. I’m sure stocks will sell better than real estate.

Investment education

Although you now have access to investing at your fingertips (all you need is a mobile phone), you must not neglect education. Find investors of interest to you and follow them on Twitter, subscribe to their newsletters and read their books.

How to start investing

If you have thought about the size of your initial investment and the length of time you want to invest, you can start choosing an investment vehicle.

Traditional investment products that even your grandmother knows

Traditional conservative investments include the investment products that every bank will offer you, and you probably have some of them. Apart from a savings account, I avoid others, but for example I had a building society savings account myself before and it’s a good start.

Building Savings

Stavebko is a product under which you save for housing (although today you can use building savings for anything) and the state contributes CZK 2,000 per year.

If you only save a minimum amount, you will earn a maximum percentage return of 3% to 4% per annum, net of fees. That’s quite a bit, and if you save more, the percentage return goes down (because the government doesn’t contribute more).

You can’t just cancel your building society savings, ideally you should top up and withdraw it at the end, as early withdrawal comes with cancellation fees that can eat up all your returns.

Savings account

Savings accounts are much more interesting in times of high inflation because they are governed primarily by interest rates set by the Czech National Bank. A few years ago, we were happy with 1%; in 2023, a savings account with a 6% p.a. return is no exception.

Every bank offers a savings account and it’s up to you which one you choose. Banks like to compete to see who can offer a better interest rate, which is a good way to attract clients. But beware, they are often limited by the amount of money, e.g. Airbank pays interest on deposits at the highest ”bonus rate” only up to CZK 250,000, then gradually reduces the interest and does not pay interest on deposits above CZK 1 million.

Everyone should have a savings account because it acts like a checking account but credits you with money every month. CZK 500,000 in a savings account will earn you CZK 2,500 per month at 6% interest.

Supplementary pension insurance

Penzijko is again a state-subsidised product, where the state adds up to CZK 230 per month to your deposit. Your employer can also contribute and the contribution is tax-free.

The aim of this product is to save for old age, so it is an investment with a long time horizon. However, pension funds do not offer any dramatic long-term appreciation; in better years, it is only a few percent.

You should therefore focus more on the non-traditional investment products that follow. 👌

Investments in securities

Securities are financial instruments (formerly literally papers!) that represent some sort of claim or interest in a company. The most common terms used in relation to securities are shares, bonds and units. You can buy all of these. 😊

How to invest in shares

A share is a security that represents a share of a company. If you buy Tesla stock, you really own a share of Tesla. As a shareholder, you are generally entitled to:

- voting at general meetings

- and a dividend (payment of part of the company’s profit).

By buying shares, you are expressing your belief that the company is well positioned and likely to do well in the future, so the share price will rise.

Picking stocks and following your favorite companies is a never-ending process, and many investors dedicate their entire lives to it. If you want to start investing in stocks, I recommend reading the book Learn to Invest by Daniel Gladish.

The problem with equity selection, however, is that few can manage to be profitable over the long term. It is simply a full-time job, which is why ETFs were created, which will be discussed shortly. These are much simpler products for us mere mortals (and investors).

In any case, you can start investing in shares very easily, today you just need to download the app on your phone, verify your identity, upload your money and you can buy immediately. I recommend it:

- Revolut – for smaller purchases and purchases of fractional shares (for example, just a tenth of a share if the whole share is too expensive)

- DEGIRO – for larger purchases and purchases of shares that Revolut does not have

- Patria – for the purchase of Czech shares

How to invest in ETFs

ETF index funds are stocks of different companies grouped together into one product. They often focus on a theme (e.g. renewable energy, hydrogen, mineral wealth, etc.), geographic region or market drivers.

As an example:

- S&P500 – An index tracking the price of the 500 largest US companies

- NASDAQ – Index tracking the price of US technology companies

- HJEN – Index replicating the price of hydrogen companies

So by buying ETFs you are buying a whole basket of companies. This eliminates the risk of hitting an unreliable company and gives you the advantage of being able to bet on the price movement of the entire industry.

There are a plethora of ETFs out there, and choosing one can be challenging, not to mention that you’ll have to search for the exchange where the fund of your choice is the best value.

💡 I recommend to create a strategy in the Czech app Port where you choose the focus where you want to invest and then just send money once a month. The port will do the rest for you. Another alternative is another Czech application Fondee which works in a similar style.

If you want to go shopping on your own, I recommend shopping through DEGIRO.

How to invest in bonds

Bonds are a special kind of security that says you lent to someone and they owe you. Bonds can also be traded on markets.

Bonds are government, corporate and private. Government bonds are almost risk-free because the state has to repay its obligations (or the Czech Republic would go bankrupt). Czech government bonds have a guaranteed yield and guaranteed repayment.

Corporate bonds are issued by companies, most often to raise funds for new production facilities, new product development or expansion. It is always necessary to properly examine why a company goes the bond route and does not go to a bank where it would get a better interest rate.

Corporate bonds have a premium valuation, often 10% to 13% per annum with a comfortable investment period of 2-5 years. On the other hand, it is a riskier investment because the company’s plan may not succeed. In the Czech Republic, several online platforms are selling bonds, for example Dluhopisomat.

P2P loans

In recent years, P2P lending has been a trending issue. P2P (peer-to-peer) lending is a type of investment product where you lend your money directly to people (personal loans) or companies without an intermediary (no bank). You are literally replacing a bank and getting a higher interest rate than if you put your money in a bank fund and it lends it for you.

Getting started with P2P is tempting and easy, but you need to beware. There are a number of P2P platforms on the internet that provide loans to every country in the world and involve less trusted entities in their systems.

Lending to farmers in Kazakhstan to repair a jiggly at 18% p.a. may sound good, but when you get an email saying the farmer hasn’t paid, there’s nothing you can do about it. Decent P2P platforms have various guarantees that theoretically help you avoid such problems, but the risk is still there.

This became a real threat during the coronavirus war in Ukraine, when all the loans I had to Russia went straight into default (no one would pay them back).

As always, the greater the return, the greater the risk. I recommend borrowing only mainly in Europe and settling for an average yield of 10% p.a.

💡 Read the detailed article about P2P investing .

For P2P investments, I recommend the following platforms:

- Bondster – Czech P2P platform

- Mintos – foreign P2P platform

- Swaper – foreign P2P platform

- Robocash – foreign P2P platform

How to invest in real estate

Buying property and then renting it out is one of the extremely challenging but relatively stable disciplines. Everything from choosing a location, to inspecting all parts of the house or apartment, to renovation, maintenance and tenant management is challenging. Not to mention the need to raise capital. And the yield? 7% p.a. is a luxury.

Therefore, you must enjoy investing in real estate (for example, building glamping cabins by the dam), or at least have a really good opportunity.

Co-investing or investing in real estate loans is a suitable alternative. I buy shares in real estate loans on the Czech app Upvest . The Czech service is also an alternative Ronda Invest which offers investments in loans secured by real estate.

How to invest in cryptocurrencies

Investing in cryptocurrencies is the opposite of investing in real estate. Cryptocurrencies are volatile, extremely volatile assets with the potential for high gains over short periods of time, but also the potential for large and unpredictable declines.

I do not recommend investing in cryptocurrencies to anyone who is not interested in learning more about how they work and who does not want to actively use cryptocurrencies. Using bitcoin, ether, or stablecoins is the way to learn the most about cryptocurrencies.

The world of cryptocurrency is the wild west where anyone can shoot you in the back. So you need to be an informed citizen and only navigate safe, lighted paths. If you stay in civilization, you’re almost guaranteed a safe cyber life. 😊

Bitcoin and Ethereum

Bitcoin and Ethereum are the two major and largest cryptocurrencies.

Bitcoin because it was the first cryptocurrency and is still what is paving the way for cryptocurrencies to enter the mainstream. I don’t mean that bitcoin is the best. On the contrary, bitcoin is an unproductive and slow cryptocurrency (kind of like Windows 95), but ordinary mortals can’t see beyond bitcoin.

The whole burgeoning world of decentralised finance, cryptocurrency community banks, autonomous organisations or digital art remains an impenetrable jungle for the general public, and while that’s a shame, as an investor I have to see it.

All investors, investment funds and even entire governments start with Bitcoin when investing in cryptocurrencies. Bitcoin is dragging the market and will continue to do so for a long time.

Ethereum is the most important cryptocurrency for me. Ethereum has become real money, a store of value. I have considered Ether (ETH) to be the best cryptocurrency investment for several years now, and that’s without taking into account the annual appreciation of the exchange rate.

Everything that is important in the world of cryptocurrencies is being dehrated on ethereum. Basically, all new and innovative projects that are created settle here. Ethereum is the largest crypto ecosystem in the world and has such a technological edge that it will likely remain so for a long time.

Where to buy cryptocurrencies

You can buy cryptocurrencies on centralized (traditional) or decentralized exchanges and exchangers.

Cryptocurrency exchanges

There are many cryptocurrency exchanges around the world. Unfortunately, cryptocurrency trading is not regulated and anyone can open an exchange. It is therefore very important which exchange you choose.

I’ve tried dozens of exchanges and experienced several crashes. I recommend you use only well-known and proven exchanges. The best in the Czech Republic

Cryptocurrency exchanges

Cryptocurrency exchanges are a good way to buy cryptocurrencies for those who do not want to actively trade cryptocurrencies. It is therefore suitable for newcomers and investors who buy cryptocurrencies for investment.

There are many currency exchange companies on the internet and it is not easy to choose. Therefore, read my list of the most well-known and proven cryptocurrency exchanges that can be used in the Czech Republic.

DeFi

Decentralized Finance (DeFi) is a cryptocurrency alternative to traditional financial instruments dominated by banks and private firms.

DeFi projects are also, in essence, banks. The fundamental difference is that they are not driven by people, but by code. Lending platforms, for example, are autonomous assemblies of computer code (protocols) working according to agreed terms that run on the Ethereum blockchain, many of which can never be changed. No authority can order the protocol to hand over your money or your data – there is no one to ask.

Cryptocurrency platforms for lending to people

In the crypt, you can lend your cryptocurrencies (including stablecoins) to anyone in the world in a decentralized way.

You deposit your crypto into the selected log and anyone can borrow from the log at interest. The loan must be pledged against other cryptocurrencies (or other assets, including gold or watches) and you as the lender are covered because if the borrower fails to repay, their collateral is forfeited to you. You can set up your loans so that you can’t lose any money (even in the event of default, you get 100% back, interest only).

The best and most secure platform is AAVE, which runs on a number of blockchains, including Arbitrum and Optimism (a fast and cheap Ethereum superstructure). You can lend stablecoins and a variety of other cryptocurrencies on Aave, with interest rates ranging from 2% to 20%.

💡 Stablecoin is a cryptocurrency with a stable value – most often 1 USD or 1 EUR. Stablecoins are classic (each coin has a real dollar deposited in the bank, e.g. USDC or USDT) or algorithmic (backed by cryptocurrency reserves that serve as underlying assets, e.g. DAI). There are also more special stablecoins, such as DOLA, which is backed by real estate.

Liquidity provision and yield farming

In the world of cryptocurrencies, liquidity is the lifeblood of every project. By providing liquidity, you allow projects to operate without high price differentials, and logs are happy to pay you for it.

You are usually entitled to two rewards:

- Share of the pool’s fees

- Extra reward in the form of native cryptocurrency protocol

With my stablecoins, I achieve appreciation between 10% and 30% p.a. without exposing myself to undue risk. However, you need to actively seek out opportunities and frequently change your investment positions even after two weeks.

Finding opportunities is time consuming, luckily there are services that do it for you. I’ve been using Beefy . Beefy is called. yield optimizer. This means that through Beefy, you can deposit cryptocurrency into any project or pool (that they have available on the site) and Beefy will reinvest all the proceeds for you on a regular basis.

Beefy operates on 20 blockchains and offers hundreds of investment opportunities. Just take your pick. 😊

DCA to cryptocurrencies

I understand that the previous lines may already seem like a Spanish village to you. If that’s the case, you might want to stick with the basic cryptocurrencies (bitcoin, ethereum) and maximize your returns.

A convenient way of buying cryptocurrencies is called. DCA (dollar cost averaging). This means that over a longer period of time, you periodically purchase an asset.

I use the app for DCA mean.finance where I top up USDC once in a while (stablecoin = 1 USD) and the app buys ether for me every day for 10 USDC. In this way, I spread my purchases over longer periods of time and flatten the purchase price curve.

Due to the fact that cryptocurrency prices are very volatile, these purchases work out a little better for me with the average purchase price than buying a bundle once a month.

How to invest in NFT

NFTs are tokens on the blockchain that can represent anything. You can also buy them for investment, the largest NFT marketplace is Opensea . However, picking the right NFTs is a complex matter and you need to be immersed enough in NFTs to spot opportunities.

In general the NFT area is quite interesting, I own for example a share in an original painting from Banksy’s Love Is In The Air I think that’s an interesting investment. As well as the opportunity to have the rights to a portion of the earnings from the songs of famous artists, which you can purchase on royal.io .

Risks of investing

Every investment carries risks and these need to be carefully considered before investing. The following is an overview of the most important ones, but in any case you should:

- Diversify your portfolio = don’t have all your eggs in one basket 😊 don’t be 100% invested in just one stock, don’t be 100% in a crypt. Spread your money across multiple investments in different sectors to spread your losses in case one sector gets into trouble.

- Keep a cash reserve = never have 100% of your investment money invested. Keep a portion in cash (e.g. in a savings account or in interest-bearing emergency reserve at the Port) so that you’re ready to buy more in the event of shortfalls.

- Keeping a long-term view = if you spend a lot of time researching a stock or other type of investment and you are convinced that you see sense in the investment, don’t be seduced by the temporary problems that can occur in any bysnyz.

Inflation

Inflation is not so much a risk as a simple fact. Thanks to inflation, the value of your money decreases every day. If the annual inflation rate is 5%, this means that your CZK 100,000 is only worth CZK 95,000 in real terms per year. You still have CZK 100,000 in the bank, but you can buy things with it that were worth a maximum of CZK 95,000 a year ago. Inflation is rising prices.

So you can measure any investment against inflation to see what real interest it is earning you. If you are invested in a project that earns you 10% p.a. and the inflation rate is 5% p.a., then you have actually only appreciated your money by 5%.

Measuring investment performance against inflation may sound strange, but there is a reason for it. States offer a special financial instrument called ”anti-inflation bonds”. You simply lend to the state and the state commits to repay you interest at the annual rate of inflation (with a slight premium).

In times of stability and low interest rates, anti-inflationary bonds are not very interesting, but in times like we will see in 2022 and 2023 they are interesting because they beat the returns on alternative investments that carry a greater degree of risk (you are more likely to be defaulted on by a small company than your own state).

So, in general, if your investment yields the same as the inflation rate, you are not earning anything, you are merely preserving the value of your money. If you don’t invest, you lose value every day.

Volatility of assets

Volatility is a lofty word for the variability of an asset’s price. Volatile assets (investments) are liked by traders who trade on the stock exchange for a living (more volatility = more opportunities), but not by ordinary investors.

Cryptocurrencies, for example, are very volatile assets that can gain or lose tens of percent in value every month. This creates opportunities for quick gains, but also for quick losses.

An example of a low volatile asset is real estate, the price of which usually changes slowly, so you won’t buy real estate today with the prospect of a fat profit in two weeks, but rather in ten years.

The action market suits everyone differently. Shark investors like rough waters and like to ride the waves, while others prefer stable markets and predictable movements.

If you are just starting out in investing, you don’t have this knowledge about yourself. But in the vast majority of cases, high volatility does not do people any good. I’ll give you two examples and you try to think which one you would feel more comfortable in:

Example 1: Peter has 100 000 CZK and buys the cryptocurrency ether because it is one of the best alternative investments. In a week, however, there will be negative news about the regulation of cryptocurrencies from the USA and the value of Peter’s investment will fall to CZK 45,000. Peter is very nervous about it and is afraid to tell his wife at home. What would she say? He lost CZK 55,000.

The next day the price drops to 40,000 CZK and Petr can’t stand it and sells. In two weeks, the price of Ethereum will climb back a bit and Peter would have had 70,000 CZK. He says to himself that it will probably go up again and he will buy again for 40 000 CZK. But the price of ethereum falls again by 20% (in real terms, absolutely normal) and Petr has only 32 000 CZK from the original 100 000 CZK, sells again and does not invest any further. All this within two weeks.

Example 2: Tomas has CZK 100,000 and, after careful consideration, uses the money to buy a stake in an investment project to build a retail park in a developing district town near Prague, where a motorway will soon be completed and new residents are expected to arrive. The loan is backed by Komerční banka and Tomáš buys conveniently through Upvest with a planned interest rate of 10% per year and a maturity of 4 years. In four years, Tomáš gets back CZK 140,000.

General market downturns (market cyclicality)

All markets (equity, commodities, real estate, cryptocurrencies,…) behave cyclically, and at different stages of the cycle you will face different opportunities, but also different risks.

Periods of growth and decline alternate, sometimes lasting a short time, sometimes longer, sometimes the declines are deep, sometimes not. Cyclicality is your enemy when you have a short investment horizon. It can happen that you buy a stock at its all-time high, then a month later it falls and then goes into a recession and you are in the red for several years.

If you have a long investment horizon and plan to buy for years, then you probably won’t have to deal with cyclicality, because you will buy in several cycles and the average purchase price will be important for you (in times of downturns you will dilute your investment with further purchases).

Exchange rate risk

The exchange rate risk is very real and quite substantial these days. Foreign investments are not made in crowns, but in dollars or euros. Do you own shares of Apple? These are valued in dollars. Are you invested in gold? This is also valued in dollars.

But you had to buy dollars with Czech crowns. And if you bought foreign stocks ”for crowns” at your broker, your broker still exchanged your crowns for dollars that day and bought in dollars.

Exchange rate risk is the fact that the appreciation or depreciation of the Czech crown against a foreign currency affects the return on your investment. Example:

You buy one share of Apple for $1,000 at an exchange rate of 24 CZK to $1. So the shares cost you CZK 24,000. In six months, the share price will still be CZK 1,000 (its price will remain unchanged), but the exchange rate of the koruna against the dollar will change to CZK 22 to USD 1. If you sell the share now, you will get back $1000, but if you exchange it back to CZK, you will only get CZK 22,000, so you will lose CZK 2000 (-8%).

From the above, it follows that the purchase of foreign currency is already an investment whose value can change.

But changing course can work in your favour too. If the koruna depreciates (it costs more and more money to buy foreign currency) and your asset increases in value (in foreign currency), your investment appreciates twice. 😊

Exchange rate risk can be insured against using the so-called. exchange rate hedgingthat you can get from any bank.

Or you can decide that you’re a global citizen anyway, there’s no harm in having foreign currencies in your portfolio, and just don’t convert them into crowns.

How to invest small amounts?

You can invest small amounts anywhere and in almost any investment instrument. Whether it’s stocks, ETFs, cryptocurrencies or real estate – as described above, thanks to online platforms you can invest in really anything with just a few crowns.

Summary – what to take away?

There are 1000+1 investment options and finding your way will take work and considerable effort. You’ll definitely get burned along the way, but you’ll learn the most from failed investments.

You can start investing even with CZK 100 in your pocket, the important thing is to persevere, educate yourself and regularly increase your investment.

Definitely diversify – never bet everything on one horse.

Have a good investing! 😊

Investing course – the best investment

When I started investing myself, I didn’t know how. I watched videos on youtube, I read many articles (like this one), but I was still not clear in my head what I wanted to start with and what strategy to choose.

That is why I absolutely and highly recommend the course of my good friend Honza Hovada, who has everything in his head about investments perfectly aligned and his course Investments and passive income from A to Z has been passed by thousands of satisfied students.

The course covers everything from an initial introduction to business philosophy, payouts and savings to sophisticated strategies and generally how to incorporate investing as a natural part of your life.

Frequently asked questions

How to invest in gold?

You can invest in gold by buying physical gold or by investing in financial products that replicate the price of gold (ETFs, gold certificates, shares of gold mining companies).

Where to invest a million

Whether you have CZK 1,000 or 1 million to invest, it depends on how long you can do without the money and how much you are willing to risk. Definitely don’t put everything into one investment, but diversify enough. Find out how to invest in the article.

How to invest money and make money

Money can be invested in many ways. The most common ones include stock buying, real estate trading, P2P lending and cryptocurrency trading.

How to secure yourself for the future

The only way to secure your future is to put aside a portion of your income in investments. Find out how to invest here.

Where to invest as a beginner?

As a beginner, invest first and foremost in investment education. Try ETFs, P2P lending and stocks.

How to value two million?

Whether you have CZK 1,000 or millions of crowns to invest, it depends on how long you can do without the money and how much you are willing to risk. Definitely don’t put everything into one investment, but diversify enough.

How to start investing with small amounts?

Investing with small amounts is possible, for example, through mutual funds, P2P or P2B loans, or even by buying fractional shares. The key is to choose the right investment instrument for your interests and risk tolerance.

What to invest in?

There are many options to invest in, such as stocks, bonds, real estate, gold, cryptocurrencies or mutual funds. Each of these assets has its own specifics and risks that need to be considered when building an investment portfolio.

How to invest in shares?

When investing in stocks, it is important to choose good companies with prospects, long-term growth and stable returns. For beginners, it is advisable to focus on index funds or investment platforms that offer broad diversification and easier management of the stock portfolio. Avoid speculation and unnecessary trading in the short term.

How to invest in cryptocurrencies safely?

Investing safely in cryptocurrencies requires a thorough understanding of the market, mechanisms and technologies behind each digital currency. It is advisable to carefully choose cryptocurrency platforms and wallets that are trustworthy and secure. Invest only as much money as you are willing to lose and remember to diversify your investments into other assets.