Lending money between people is nothing new in the world, but it was not until 2005 that the first p2p platform operator thought of making p2p lending a regular business and a source of passive income for anyone. Today, the p2p lending market is well-developed and offers a variety of ways to start investing.

What peer-to-peer (P2P) lending means

Today, with interest rates on savings accounts and conservative bank funds barely outpacing inflation, investors are looking for alternative ways to value their money.

At the same time, people who would like to borrow money but for some reason cannot or do not want to borrow from a bank are also looking around.

Peer-to-peer lending is a type of lending where one person lends to another person (or loan company) at interest. (It is therefore the opposite of traditional banking services, such as credit or home loans.)

Finding such an investor, however, used to be difficult for the prospective borrower (hard to meet on the street) and highly risky for the lender. If the debtor stops paying, he loses everything.

Fortunately, in 2005, an idea emerged to simply connect the two parties via the Internet and the first P2P platform Zopa was created.

| Benefits of P2P lending | Disadvantages of P2P loans |

| ✅ Yield 3% to 20% depending on risk | ❌ Can be risky with bad credit collections |

| ✅ Investing without a banker | ❌ Risk of P2P platform crash (small) |

| ✅ Possibility of wide diversification | ❌ Sometimes non-transparent intermediaries |

| ✅ Choice of many P2P platforms | |

| ✅ Simple form of investing |

What are P2P platforms

There are a number of so-called. P2P platforms (list of the best ones at the end of the article) that allow non-bank credit companies to fund loans to members of the public.

You lend to other people in the form of microloans, so you can start investing with any amount. I started with 1,000 CZK.

An example of how P2P lending works:

- Petr decides that he wants to buy a car for 200 000 CZK. So he goes to one of the loan companies and applies for a loan.

- The company will assess Peter’s ability to repay and offer him a certain interest rate and repayment period. Peter nods.

- The credit company will give Peter from its e.g. 10 % (20 000 CZK) and the rest is demanded by us, the public, through a P2P platform.

- Many people will contribute the remaining CZK 180 000 in the form of micro-loans. Everyone lends Peter, for example. 300 CZK for 10% interest.

This way, you can invest in hundreds of different loans at once through P2P platforms, spreading the risk across multiple borrowers.

Investing in loans itself is extremely simple (two clicks) and if you don’t want to actively manage your loan portfolio, Auto Invest is free to use.

Auto Invest is a service offered by every P2P platform. Based on the rules you set, the money is automatically invested and you have almost nothing to worry about.

How much you can earn on P2P

Many factors affect the profitability of P2P loans, but typically interest rates on loans range from 5% to 20%. Some platforms offer loans with a range of interest rates, others have a fixed interest rate.

Each month, interest and a portion of the principal (repayment) is credited to your platform account on the invested loans. You can dispose of this money as you see fit. You can either reinvest it (borrow it) or send it to your account and spend it.

How to get money on platforms and then withdraw it

Most of the loans on the platforms we use are made in euros. To avoid paying bank fees for converting Czech crowns to EUR, we use Revolut.

You can simply top up your Revolut account with Czech crowns via a payment order or credit card and convert them to EUR for free at the mid-rate (up to CZK 120,000 per month, completely free of charge). You then send the Euros to the IBAN account specified in the platform.

It takes the longest time for the euros to be credited to the platform’s account. The best experience we have is with Mintos, where euros appear within hours.

Withdrawing money from the platforms is similar. Simply request the money to be sent back to your bank account or Revolut account.

Can money be withdrawn FAST if needed?

On most platforms, in addition to the primary market (new loans), there is also a secondary market where investors sell their existing loans.

So you can offer your existing loans on the secondary market and once someone buys them from you, you can withdraw the money.

My best experience with the secondary market is again on Mintos, where the secondary market is liquid enough and I have always sold all my loans within a few hours without having to discount them.

Risks associated with investing in P2P loans

Of course, investing carries risks, and P2P lending is no different. Let’s take a look at the biggest risks associated with P2P platforms.

Early payments

It happens quite often that borrowers repay their loans early. If you don’t keep an eye on your account (and you don’t have Auto Invest turned on), you may have unnecessary money sitting in your account.

Exchange rate risk

Investing in P2P lending is mostly done in foreign currencies and this carries exchange rate risk. On the other hand, against strengthening/weakening currencies, it is good to have money in multiple currencies. 🙂

Individual’s inability to repay

One of the basic risks is the debtor’s inability to repay. If Peter runs out of money, he’s unlikely to send you the steering wheel of his car instead.

Fortunately for us, many lending companies offer a buyback guarantee on problem loans. If Peter stops paying, the loan company will buy the loan from you and you will lose nothing.

This only applies if you are investing in a loan with this guarantee. You can tell by seeing the ”Buyback Guarantee” light on the platform next to the loan .

The collapse of a credit company

The buyback guarantee is useless if the whole loan company goes bankrupt. In this case, you will probably lose the money you invested.

Therefore, you should always make sure that you have money invested in loans on multiple loan companies. There are dozens of them on P2P platforms.

P2P platform crash

The platform as such will hardly fail. It doesn’t hold any money, it just collects data.

Global crisis

This is the great unknown. The P2P market has not yet experienced any major crisis, so no one can say for sure how the industry will evolve. In general, however, we can expect more loan defaults as people losing their jobs will not have the money to repay.

How to manage risk when investing in P2P

The basis of smart investing is spreading risk, and this is relatively easy to do with P2P.

Diversification between platforms

Different platforms offer different returns, but they also come with risks. For example, on the Robocash platform, it happens that they don’t have enough loans and your money sits idle.

That’s why I recommend investing on multiple platforms. My combo: Mintos, Swaper and Grupeer.

Diversification among credit companies

Each credit company has a rating on the platforms. The smaller and riskier a company is, the worse its rating. On the other hand, these companies often offer higher interest rates because they lend in riskier countries or to riskier people.

It therefore makes sense to invest in loans with different companies to reduce the risk of their failure affecting your portfolio.

Diversification between currencies

Diversification between different currencies necessarily means that you invest in different countries. When you have loans spread around the world, you protect your investments against local crises that can affect national financial markets.

If, for example, people in the Czech Republic stop paying in bulk, it does not jeopardise your USD loans, because you only make them to US citizens.

Diversification between loans with different levels of risk/return

Investing in different currencies gives you access to less accessible markets. I, for example, invest in loans in Kazakhstan, with interest rates around 17%.

However, I hold most of my portfolio in loans in European countries at a lower interest rate (9%) because they are safer.

List of recommended P2P platforms where you can register for free and start investing

Mintos

Mintos is my favourite platform. Read my extensive Mintos review .

It has a clear interface that is fully translated into English. Once you’re logged in, you’ll instantly see simple stats on your loans and Auto Invest works seamlessly.

There is a well-developed secondary market on Mintos that will come in handy when you need to get rid of your loans. You can sell your loans to other investors at a discount, but also at a premium.

- The minimum investment per loan is set at EUR 10 (or CZK 300).

- On Mintos, you can expect a return between 6% and 18%.

By registering via this link you will receive a bonus return of 0.5%.

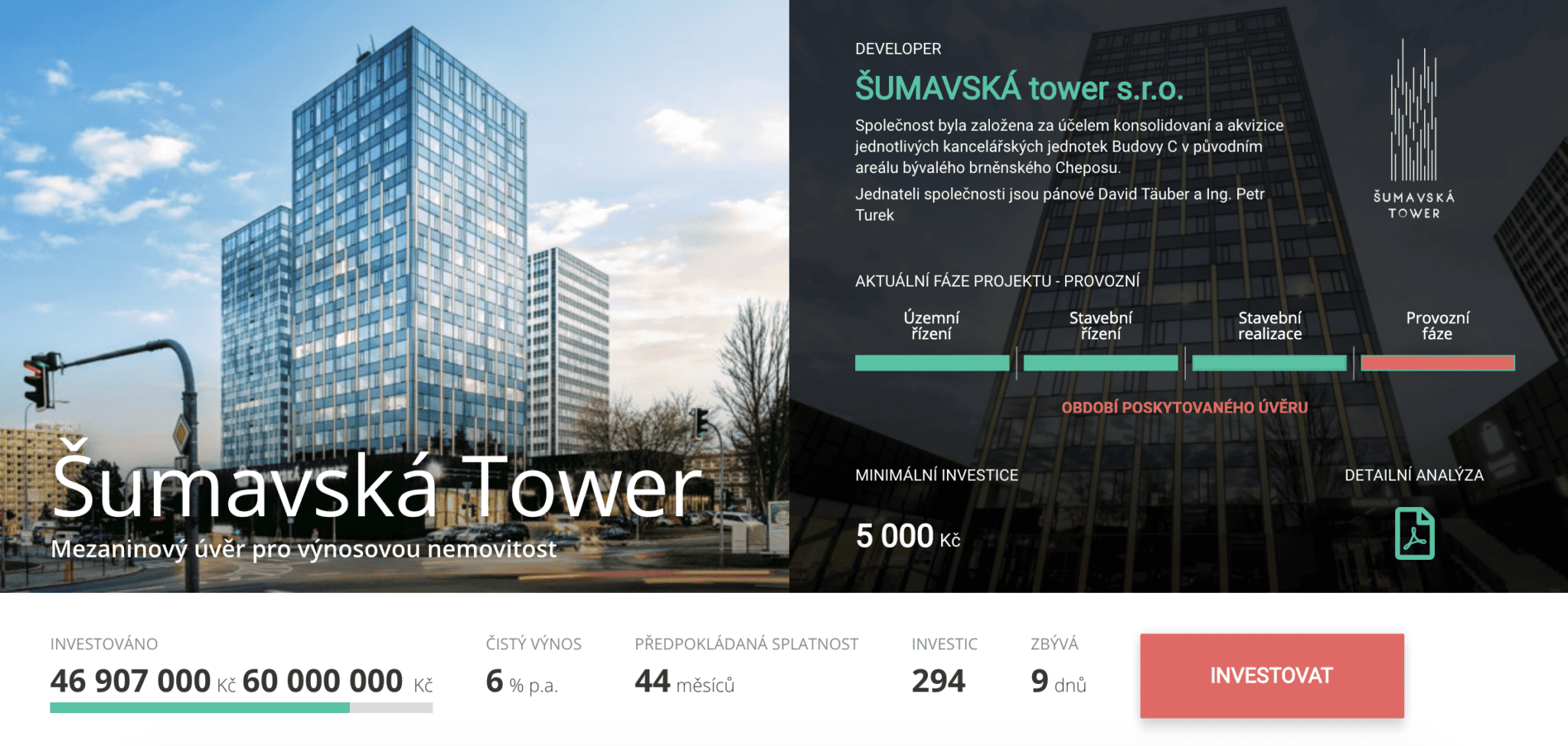

Upvest

Upvest is a Czech crowdinvesting company that offers retail investors the opportunity to participate in large development projects in the Czech Republic.

Upvest works in close cooperation with Komerční banka and offers only thoroughly researched investment opportunities that carry very low risk.

This is matched by lower yields, which range between a net 5% and 7% p.a.

By registering via this link you will receive a bonus of 500 CZK for your first investment.

Robocash

Robocash is a fully automated platform that will invest in P2P loans for you. You are only required to load your account and determine your strategy or risk. By choosing the range of loans you are willing to purchase, you are telling the platform how to handle your finances.

It is a simple and automatic investment in P2P loans, ideal for newcomers or passive investors who don’t want to actively manage their portfolio.

Read my review , or use

Swaper

Swaper is advantageous in that it offers a single interest rate. The current rate on all loans is 14%. If you invest more than €5,000, you will receive an additional 2% as a bonus.

It also offers a clear app and simple Auto Invest. All loans that are more than 30 days past due will be purchased from you by Swaper. Read my review .

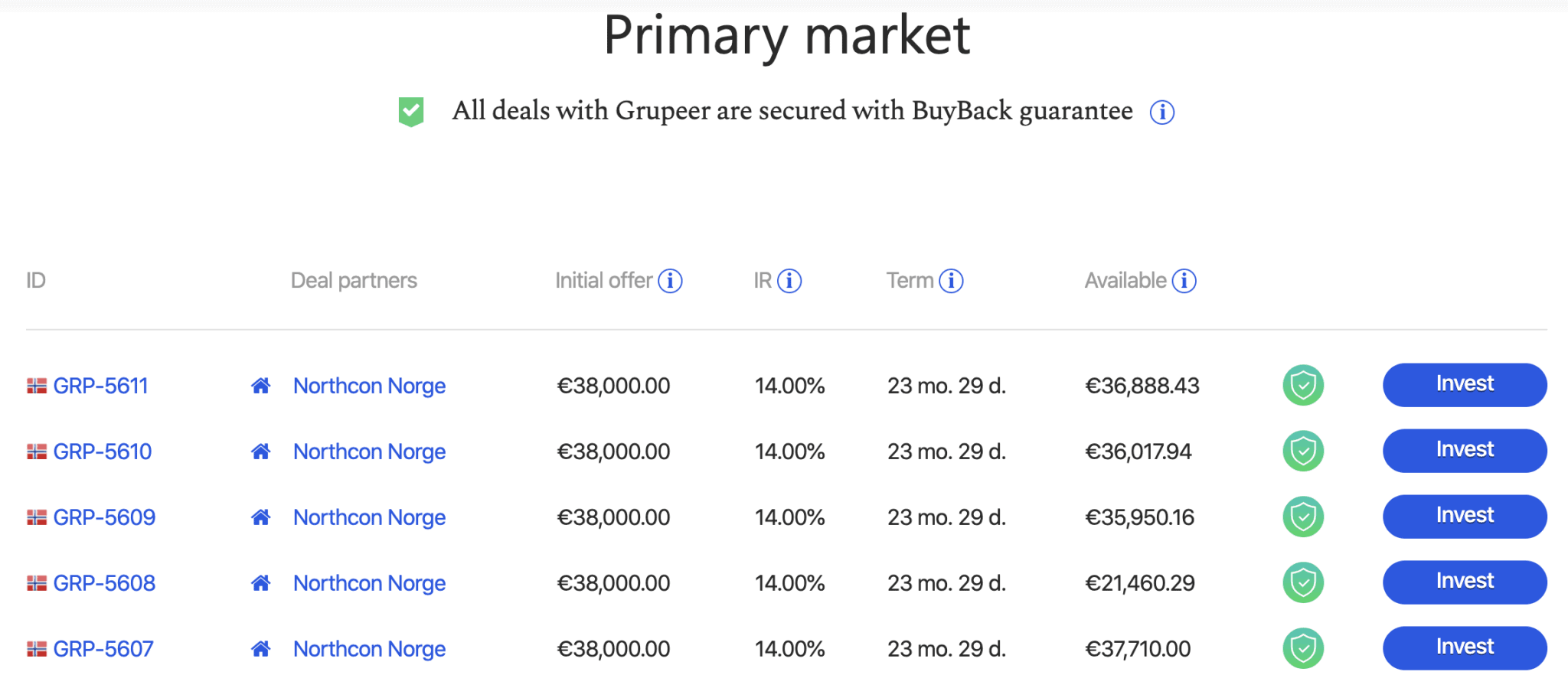

Grupeer

Grupeer offers investment loans for business, construction and real estate purchases. All loans are protected by a buyback guarantee.

An interesting feature is the Stability Fund, where you can literally buy square meters of a property and receive a share of the rent as a co-owner.

By registering via this link you will receive 10 EUR for investment.

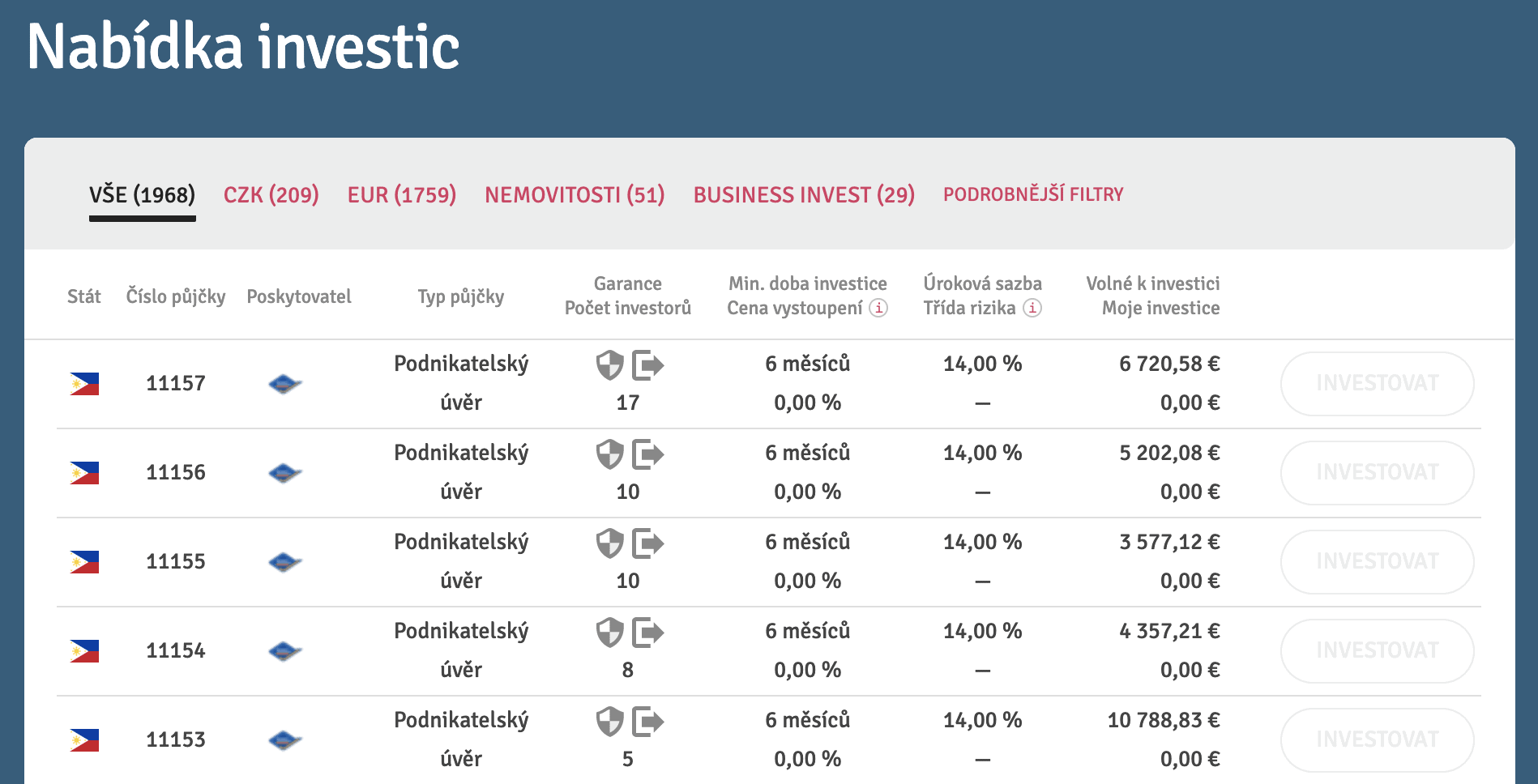

Bondster

Bondster is a Czech platform that offers investments in business and consumer loans in CZK and EUR. Yields range from 4% to 14%.

Bondster investors have an average annual return of 7.17% in Czech crowns and 12.47% in euros.

➜ Bondster review: detailed analysis of the plaforms

By registering via this link you will receive a 1% bonus.

Are you interested? Would you like to learn more about building passive income, including practical tutorials and video content?