Are you digital nomads, frequent travelers, or planning to go abroad for an extended period? Then you are surely addressing the question of travel insurance. Which insurance is reliable, affordable, and adapts to your lifestyle? In this SafetyWing Long-term Travel Insurance Review I will cover the key features and help you decide if it suits your needs.

We have a review for you on SafetyWing, insurance tailored for digital nomads and long-term travelers. Read why we consider it the best choice on the market and how it can make your worldwide travels easier.

SafetyWing Travel Insurance: Basic Information

SafetyWing is international travel insurance focused on digital nomads and long-term travelers. The company offers health and travel coverage that is easily accessible and adaptable to your needs.

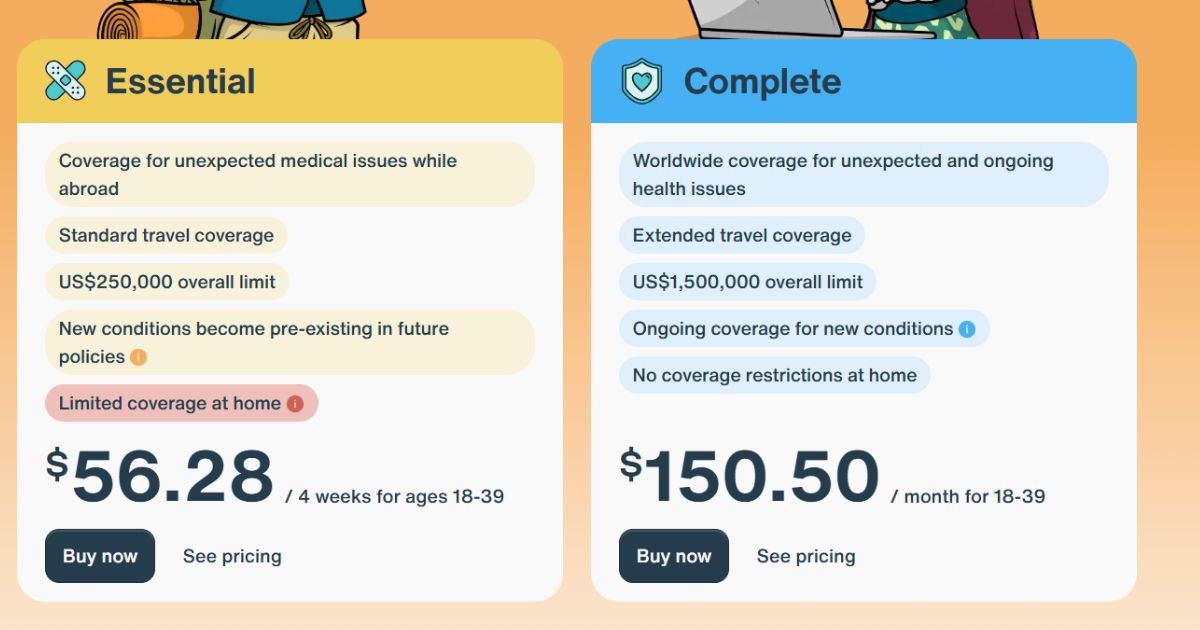

SafetyWing offers two variants of travel and health insurance: Nomad Insurance, namely the Essential and Complete variants.

The basic Essential plan for individuals aged 10-39 costs from $56.28 for 28 days (extended coverage for the USA or hazardous sports can be added) and coverage includes medical treatment, hospitalization, transfer to hospital, lost luggage, traffic accidents, trip interruption, flight delays, and life insurance. Total coverage is limited to $250,000 per incident.

The Complete variant provides more comprehensive coverage. The main advantage of this plan is a high overall coverage limit of $1,500,000. It covers not only unexpected medical issues but also ongoing medical care and preventive doctor’s visits. Other included services are:

- Transfer to a better-equipped hospital.

- Lost luggage coverage.

- Psychological assistance.

- Visits to various specialists (e.g., gynecologist, dermatologist, chiropractor, acupuncture).

- Cancer examination and treatment.

- Care for pregnant women.

- Theft insurance.

- Reimbursement of costs for trip delays or interruptions due to family or health reasons.

- Coverage for transfer or funeral costs in case of death.

The price for individuals aged 18–39 starts at $150.50 for 28 days, with the option to add extended coverage for the USA or hazardous sports.

💡You might also be interested in: Best Annual Travel Insurance

How to File a Claim with SafetyWing

If you need to file a claim with SafetyWing, you can do so easily online via the online form found after logging into your account. Simply upload the necessary documents, such as medical reports or receipts, and submit your application, which will take approximately two minutes.

Although the standard processing time for an insurance claim can take up to 10 business days, the average waiting time with SafetyWing in 2024 has shortened to just four days, which is much faster than most competing companies.

Although some people in reviews state they had issues with claim processing, which is quite common with insurance companies, it is essential to have all documents in order for successful processing. It is important to prove that it was not a pre-existing condition (“pre-existing condition”), but truly an unexpected emergency. Therefore, I advise you to keep all documents such as medical reports, receipts, and similar.

SafetyWing Travel Insurance – Review

Now let’s move on to the review of SafetyWing‘s insurance services.

Who is SafetyWing Travel Insurance Suitable for?

SafetyWing is an ideal choice for digital nomads, freelancers, international students, and travelers who frequently change destinations and are looking for flexible travel insurance. Thanks to its easy setup and lower monthly payments, it is also suitable for those who want to travel for a longer period, perhaps a year or more. And due to its flexibility, it is also a great option for those who don’t know how long they will be on the road.

Who is SafetyWing not Suitable for?

If you’re planning a one-week trip to a resort in Turkey or Croatia once a year, SafetyWing insurance is unnecessary overkill for you. A weekly insurance policy from one of the Czech insurance companies will suffice, and often your travel agency covers you.

Isn’t this Insurance Too Expensive?

In conversion, the cheaper Essential variant comes out to just over 1300 CZK per month. Does that seem like too much? In the Czech Republic, you will certainly find offers for annual long-term insurance around 10,000 CZK, and at first glance, it seems like a better option. However, when you focus on the details, such as coverage amounts, deductibles, and often very long (even several densely written pages) lists of exceptions, you will find that cheaper offers are not that advantageous anymore.

You often find out that you have to return home every three months, that you have to pay for treatment yourself (and the insurance company will only reimburse it retroactively), or that you cannot purchase insurance from abroad (if you are outside the Czech Republic, a Czech insurance company simply won’t arrange it with you).

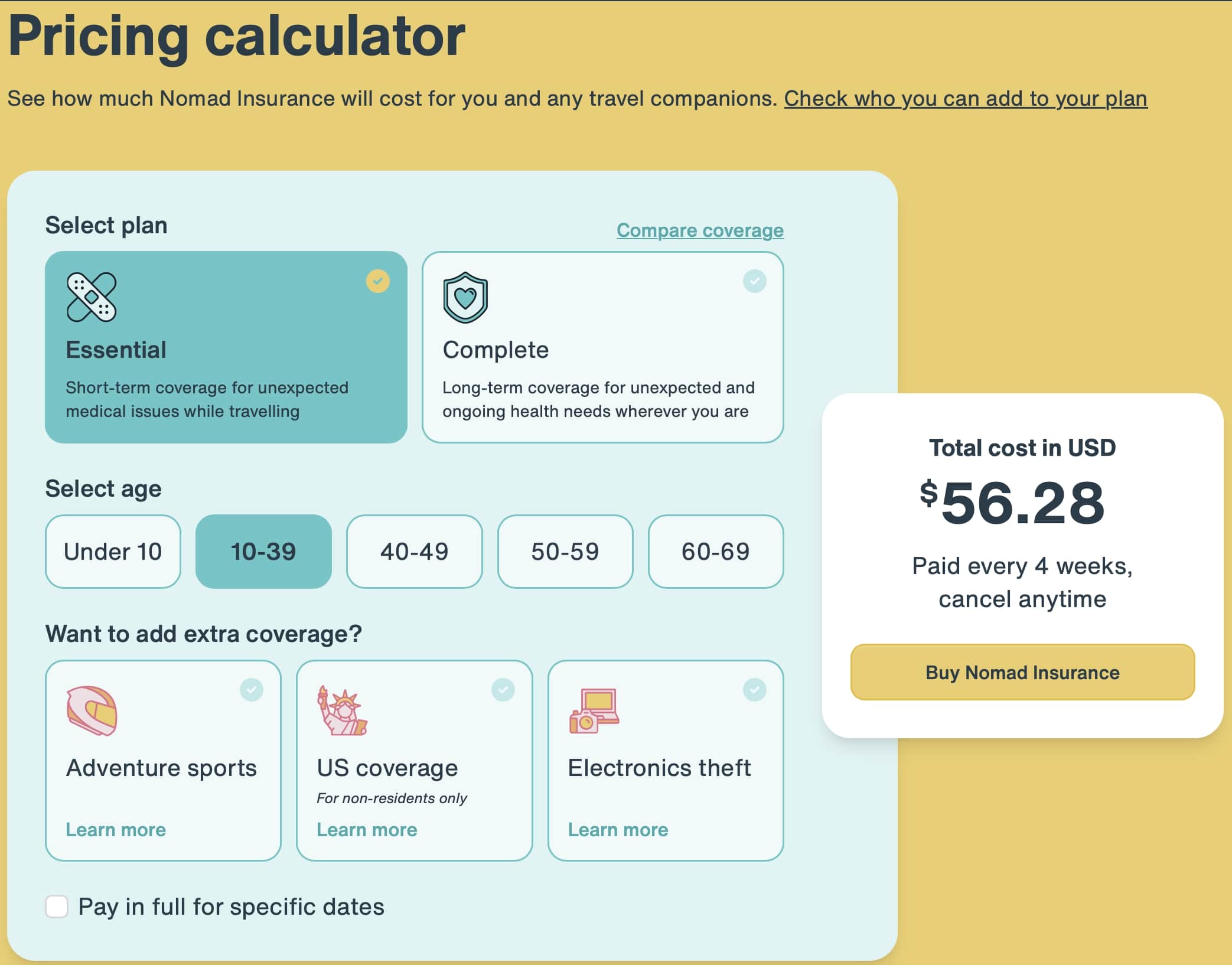

For a quick calculation of how much SafetyWing insurance will cost you for a specific trip (for example, if you are going to the USA and, God forbid, you are doing an extreme sport, or carrying expensive electronics), use their Price calculator.

Pros and Cons of SafetyWing Travel Insurance

We love lists, so here’s a clear one about the pros and cons.

In our opinion, the main advantages of SafetyWing insurance are:

- ✅Global Coverage: The insurance is valid in over 180 countries, with the option to add coverage for the USA.

- ✅Flexible Planning: Insurance can be arranged online anytime, anywhere, for both short and long periods. Payments are made every 4 weeks, and you can cancel the insurance at any time.

- ✅Monthly Subscription: You pay for the insurance every four weeks (28 days), just like for Netflix, so you don’t have to spend a large sum of money all at once.

- ✅Simple Claims Process: Thanks to fast claim processing, you can get your money back within a few days.

- ✅Support Availability: The customer support team is available 24/7 and usually responds within one minute.

- ✅Unlimited Days: If you arrange annual travel insurance with any Czech insurance company, you will find that after a certain period, you will have to return to the Czech Republic (usually after 45 or 90 days). With SafetyWing, you don’t have to return.

- ✅Purchase from Anywhere: You can arrange insurance even from abroad. Moreover, after 90 days, you can return to the Czech Republic for up to 30 days and still be insured. This way, you avoid the necessary calculations of when it’s worth canceling your health insurance in the Czech Republic and when it’s not yet.

- ✅Affordability: The price starting from $56.28 for 4 weeks for individuals aged 18–39 is among the cheapest on the market.

- ✅Direct Payment to Hospitals: SafetyWing pays bills directly. This means you won’t have to pay for care invoices yourself.

- ✅Coverage for Treatment in Private Facilities: You don’t have to be afraid to visit private clinics and hospital facilities abroad, which are often better, especially in developing countries.

Among the disadvantages, we would include:

- ❌Pre-existing Conditions Not Covered: Illnesses diagnosed before the policy agreement are not included in the insurance.

- ❌Limited Home Coverage: If you return to your home country, insurance coverage is limited to 30 days (for the Essential variant).

- ❌Special Add-ons Come at an Extra Cost: For example, coverage for adrenaline sports, electronics theft, or travel to the USA are subject to an additional charge.

- ❌Insurance Deactivates After One Year: After 364 days of travel insurance, the policy deactivates unless you confirm renewal via email. Be aware of this.

- ❌Communication Only in English: All communication, including arrangement, cancellation, and filing claims for medical expenses, takes place in English.

SafetyWing: Review Summary

SafetyWing Review

Review Summary

For us, SafetyWing travel insurance is the best possible choice. The insurance is affordable (compared to Czech insurance companies), easy to negotiate and designed with the needs of avid travelers in mind. Despite a few minor complaints, SafetyWing offers an excellent price-performance ratio, which is why we can definitely recommend it. If you are looking for insurance that adapts to your traveling lifestyle, SafetyWing is a great choice.

FAQ

What products does SafetyWing offer?

Nomad Insurance: Basic health and travel insurance in two variants – Essential and Complete.

Remote Health: Comprehensive health insurance for teams and individuals with global coverage.

Can I arrange travel insurance from abroad?

Yes, you can arrange SafetyWing insurance from anywhere, even during your trip.

Does SafetyWing cover medical care in my home country?

Yes, but only after 90 days of travel can you spend up to 30 days in your home country and still be covered. For the USA, it’s up to 15 days.

Is the coverage suitable for adventure sports?

Yes, for an additional fee, you can arrange special coverage for hazardous sports such as mountaineering, diving, or skiing.

How much does the insurance cost?

The price starts at $56.28 per month for individuals aged 18–39. The exact amount depends on the chosen variant, your age, and selected add-ons to the basic insurance.

Is SafetyWing insurance also available for travel to the USA?

Yes, travel to the USA is covered, but it is necessary to pay extra for extended US health coverage.

Tips and Tricks for Your Vacation

Don’t Overpay for Flights

Search for flights on Kayak. It’s our favorite search engine because it scans the websites of all airlines and always finds the cheapest connection.

Book Your Accommodation Smartly

The best experiences we’ve had when looking for accommodation (from Alaska to Morocco) are with Booking.com, where hotels, apartments, and entire houses are usually the cheapest and most widely available.

Don’t Forget Travel Insurance

Good travel insurance will protect you against illness, accidents, theft, or flight cancellations. We’ve had a few hospital visits abroad, so we know how important it is to have proper insurance arranged.

Where we insure ourselves: SafetyWing (best for everyone) and TrueTraveller (for extra-long trips).

Why don’t we recommend any Czech insurance company? Because they have too many restrictions. They set limits on the number of days abroad, travel insurance via a credit card often requires you to pay medical expenses only with that card, and they frequently limit the number of returns to the Czech Republic.

Find the Best Experiences

Get Your Guide is a huge online marketplace where you can book guided walks, trips, skip-the-line tickets, tours, and much more. We always find some extra fun there!