Whether you’re a digital nomad, a long-term traveller, or just planning an extended trip, the right annual travel insurance is an absolute must-have before you set off.

Insuring your health while abroad is a non-negotiable necessity. But there are countless insurance companies out there, and comparing them is far from straightforward.

On top of that, once you start looking into your options, a whole flood of questions hits you. Should I get health insurance only? Or should I also cover my phone and laptop? What about luggage? Or flight cancellations?

Best annual travel insurance for long trips

Don’t want to read further and just want to buy the best? Here are our two top recommendations:

1) Safety Wing – top travel insurance for long-term trips

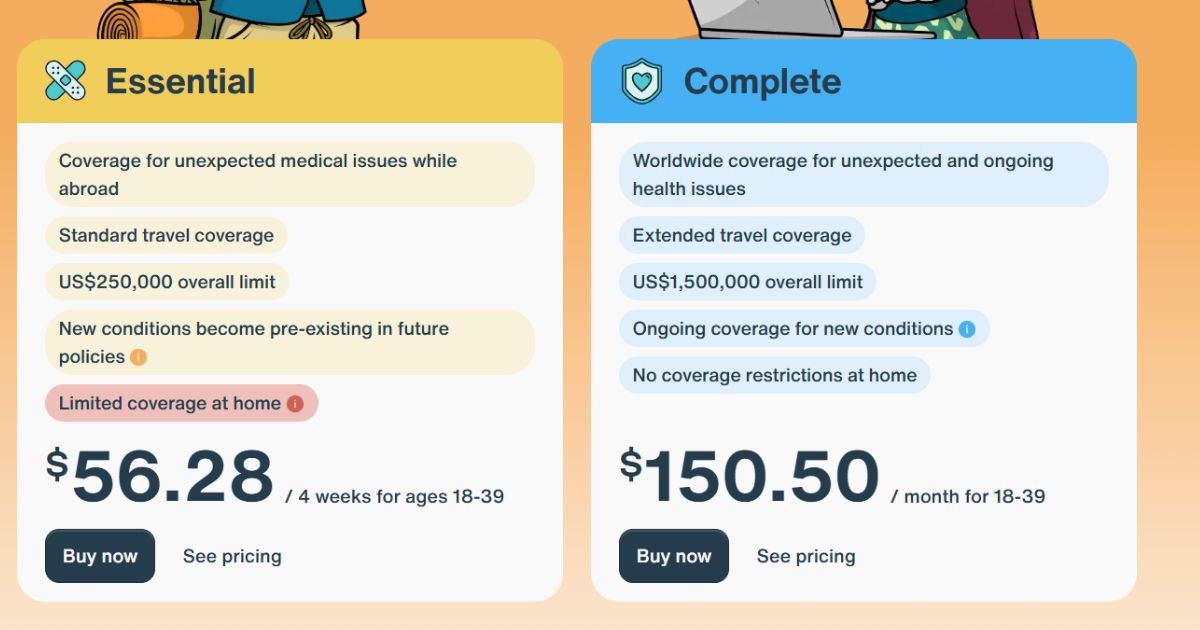

Safety Wing is travel insurance tailor-made for digital nomads and frequent travellers. You can be continuously insured and pay monthly (you can cancel anytime). The basic plan without US coverage starts at $56.28 per month, and you can travel anywhere in the world.

You can purchase the insurance even from abroad, and after 90 days you can return home for up to 30 days while still being covered. This eliminates the hassle of calculating when it’s worth cancelling your domestic health insurance and when it’s not.

Another great advantage of Safety Wing insurance is that you don’t have to return home at all – unlike many traditional insurers that limit you to 45 or 90 days abroad before requiring a trip back.

The Essential plan for individuals aged 10–39 starts at $56.28 per month (you can add extended US coverage or adventure sports), and coverage includes medical treatment, hospitalisation, hospital transfer, lost luggage, trip interruption, and flight delays. The overall coverage is capped at $250,000 per incident.

More comprehensive coverage is offered by the Complete plan. The main advantage of this plan is its high overall coverage limit of $1,500,000. It covers not only unexpected medical issues but also ongoing healthcare and preventive check-ups. Additional covered services include:

- Transfer to a better-equipped hospital.

- Lost luggage coverage.

- Mental health support.

- Theft protection.

- Coverage for trip delay or interruption due to family reasons.

- Repatriation or funeral costs in case of death.

The price for individuals aged 18–39 starts at $150.50 per month, with the option to add extended US coverage or adventure sports.

Why don’t we recommend a mainstream UK insurer right away? Because they come with too many limitations. They impose limits on the number of days abroad, credit card-linked policies often require you to pay medical expenses with that specific card, and they frequently limit how many times you can return home.

2) True Traveller – ideal for backpackers, gap year, and frequent travellers

True Traveller is the most flexible and comprehensive long-term travel insurance you can find – especially for its price. For around €450 per year, you get worldwide travel insurance (USA and Canada available as an add-on). Coverage limits are generous (up to €6 million), and you can add various travel packages, including extreme sports and skiing. Non-manual work is included in the basic plan, and manual work can be added for an extra fee.

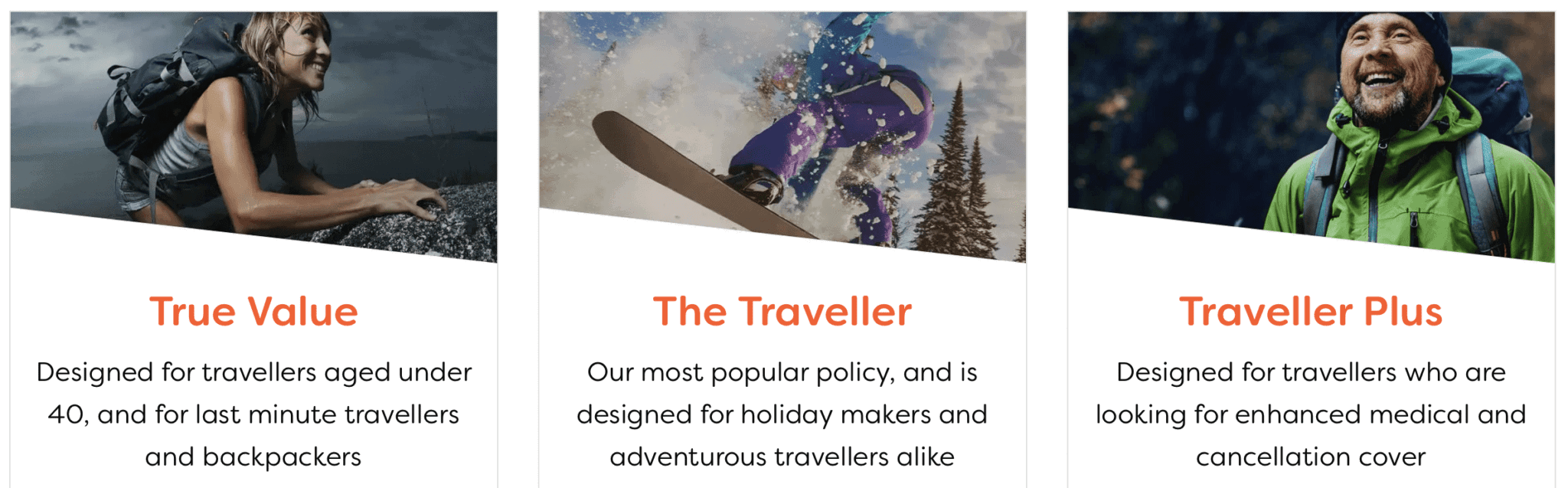

True Traveller offers three main plans: True Value, Traveller, and Traveller Plus. Each plan offers a different level of coverage. The cheapest True Value plan includes medical expenses up to £2.5 million, but coverage is more limited than the other two plans. The Traveller plan offers higher limits for medical costs, as well as trip cancellation and delay coverage, while Traveller Plus has the highest limits and also includes higher amounts for legal expenses.

Another advantage of True Traveller insurance is that you can choose whether to add coverage for specific activities or winter sports, allowing you to tailor the insurance to your specific needs and reduce costs.

When it comes to flexibility, True Traveller allows home visits during your trip – insurance is paused while you’re home and resumes when you head back out. The insurance can also be easily renewed while travelling, in case you forget to renew your contract on time.

Just like Safety Wing, the insurance can be purchased while you’re already on the road, and you can be covered without a return ticket.

Is it worth insuring your belongings?

While insurance for accidents, evacuation, and natural disasters is standard for long-term travelling, you should think twice about whether you really need to insure anything else.

Just because an insurer offers gadget cover doesn’t mean it’s worth it. As you’ll discover from their price lists, insuring a MacBook or iPhone is quite expensive.

If you’re travelling with a professional camera and several devices, such add-on coverage can easily cost you more than €600 per year, while insurers typically only cover individual items up to around €600–800.

I understand that the thought of buying a new laptop for €2,000 fills you with dread (similar to our experience when we drowned a nearly new MacBook Pro in a tent). But is it really worth paying the insurer an extra €600 every year “just in case”?

Luggage insurance is practically pointless because insurers typically exclude electronics from it. I don’t know about you, but for us, most of the value in our luggage is the tech we’re carrying.

What type of travel insurance to choose

Travel insurance can be divided into three categories, each covering something completely different.

Travel health insurance

Standard health insurance from your home country usually doesn’t apply when you’re abroad.

💡 The exception is travel within the European Union and certain EEA countries, where your European Health Insurance Card (EHIC) will give you access to basic necessary medical care in case of a health issue. However, you’ll be treated under the same rules as locals – if healthcare is expensive for residents, it’ll be expensive for you too. More info here.

So it’s crucial to get properly insured. Because what will you do if you catch an illness or have an accident somewhere in New Zealand, Uganda, or anywhere else that requires immediate local treatment?

Local treatment can cost a fortune, and without proper insurance you’ll be paying thousands of pounds for care that you’re used to getting for free through your national health service.

Keep in mind that almost no insurer will allow you to receive long-term treatment abroad. As soon as it’s feasible, they’ll repatriate you to your home country, where your ongoing treatment will be covered by the national health system.

Medical evacuation insurance

When signing an insurance contract, you’ll often come across the term “emergency medical transportation.” It’s either included in your policy (with most insurers) or available as a standalone product. What is evacuation insurance for?

This type of insurance is most commonly used when the hospital where you end up isn’t equipped to handle the treatment you need. A typical example is when the hospital doesn’t perform the type of surgery you require.

Your attending doctor may request a transfer to a better-equipped facility. And it’s precisely this additional transfer that’s covered by the special insurance package. We strongly recommend getting evacuation coverage as part of your main insurance, not as a standalone service. With a standalone service, only the transfer itself is covered – not the subsequent treatment!

What type of travel is evacuation insurance most useful for? Primarily if you’re heading on long hikes into the wilderness, or travelling through less developed countries with inadequate healthcare infrastructure. In larger cities and developed countries, you generally won’t need evacuations. Transfer insurance can also be arranged for individual trips.

Coverage limits range from around €20,000 to millions (including unlimited limits). It might not seem obvious at first, but a helicopter evacuation with a search and rescue operation from remote mountains can rack up an astronomical bill, so we recommend a minimum limit of around €120,000.

Travel insurance for belongings

A separate category is insurance for third-party liability, loss and theft, or flight delays. These are often included with credit cards, but you need to carefully read the terms and conditions.

This type of insurance is often the most expensive item, especially if you want to cover photography equipment and electronics you’re travelling with. Many travel health insurance plans already include this type of coverage to a limited extent, or offer it as an add-on.

If you don’t get a good deal bundled with your health insurance, or if you don’t have bonus coverage through a credit card, this type of insurance is often not worth purchasing at all. Why?

- There’s a very small chance something like this will actually happen

- When something does happen (e.g., your hire car gets broken into), the insurer will likely find an exclusion in the contract to avoid paying out

- When something does happen, replacing stolen equipment or buying a new flight out of pocket may be cheaper than the insurance itself

- In many cases, you’re entitled to compensation from a third party even without insurance (e.g., for delayed flights)

As an example, let’s look at the popular product missed connection insurance. Most insurers require a minimum of two to four hours between flights as a baseline condition, or they won’t consider your claim at all.

You only need delay insurance if you’re travelling on two separate tickets. If you have a connecting flight on a single booking (one airline), the plane will either wait, or you’ll get an alternative flight/compensation. And how many connecting flights are actually missed? It’s 0.1% to 1.5%. And how many times a year do you fly? 🙂 Missed connection insurance simply doesn’t pay off.

Tips for choosing the right insurance

When choosing long-term insurance, you should focus mainly on specialised providers, most of which are international. Why? Because mainstream domestic insurers typically have significant limitations for “long-term” coverage:

- They impose limits on travel days. You’ll encounter 30, 60, or 90-day limits after which you must return to your home country, even if just for a quick airport turnaround.

- If the insurance is tied to a credit card, they may require you to pay 50%–100% of your travel costs with that specific credit card.

- If you do find annual insurance, the number of home visits is often limited. Often, your second return home in a given year will invalidate your policy, with no refund.

Also watch out for excess (deductible) payments. Either the excess is charged every time you make a claim, or just once for the entire insurance period. The second option is obviously better, because if you claim multiple times in one period, you only pay the excess once.

When renewing your policy, keep in mind that if you made a claim during the previous period (say, for emergency dental treatment), they may exclude dental cover in the new year (or charge extra for it).

Overview of the best annual travel insurance

Below is an overview of insurers that specialise in long-term travel and digital nomads. We’re assuming you have standard health insurance in your home country.

All the insurers mentioned allow you to take out a policy even when you’re already travelling and don’t restrict the time you spend abroad. This means you don’t need to repeatedly return home during the insurance period.

SafetyWing

SafetyWing is our number one pick. SafetyWing is a startup that brought the subscription model (think Netflix or Spotify) to the insurance world.

Don’t be put off by the word “startup.” Although the idea was born from digital nomads like us, their underwriting partner is one of the best insurance companies in the world – Tokio Marine.

SafetyWing is a worldwide, location-independent safety net for all freelancers and digital nomads. That’s why they already offer a whole range of features that other companies lack.

What’s really great about SafetyWing?

- Monthly subscription. You pay monthly and, just like Netflix, you’re not committed to any fixed term. You can cancel the next payment at any time.

- Affordable price. Actually one of the lowest when you compare like-for-like coverage from other providers.

- Annual cap on excess. No matter how many times you claim in a year, you’ll pay a maximum of $250 in total excess.

- Zero excess for many claims, such as emergency dental treatment, hospital transfer, trip interruption, lost luggage, travel delay, third-party liability, and more.

- Covers treatment at private facilities. You don’t need to seek out public hospitals and doctors. Especially in developing countries, private doctors are often far superior.

- Pays hospitals directly. Unless you specifically insist on a different facility, SafetyWing settles bills directly. That means you won’t have to pay invoices yourself (and then wait for reimbursement).

- Home country coverage. Even if you don’t have health insurance in your home country (e.g., if you went to work in Canada for a year), SafetyWing covers you at home too – for up to 30 days per 90 days of insurance. That’s a total of 120 days per year of insurance.

- Same price whether monthly or annual. With most insurers, the shorter the policy, the more you pay per day. With SafetyWing, you always pay the same rate. This makes it a great option even for shorter trips.

What to watch out for with Safety Wing

Insurance for trips to the USA is more expensive, so we recommend only activating the US add-on for the period you’re actually there. Once you leave, switch back to the cheaper plan.

After 364 days of insurance, the contract deactivates – unless you confirm the renewal via email. Make sure you don’t miss this.

Insurance longer than 28 days is billed every 4 weeks. So you don’t have to pay a large sum upfront, unlike with most other insurers. You can find the full policy wording here.

SafetyWing also offers special plans for startups and online businesses with employees around the world. Through a single subscription, you can provide medical care for your team anywhere on the globe. The product is called Remote Health.

SafetyWing insurance calculator

True Traveller

True Traveller is a British insurer particularly popular among residents of the European Economic Area, as it’s only available to EEA residents.

The cheaper plans from True Traveller offer good value, at least if you commit to a minimum of one year. Unlike SafetyWing, they offer a whole range of add-on coverages (which SafetyWing includes as standard) that can add up.

What’s really great about True Traveller?

- Coverage up to £10 million, which many competitors can’t match.

- Policies can be taken out for up to 18 months. Plus, you can extend them. The downside is that you pay the premium upfront in full.

- The basic plan covers over 90 sports and activities.

- You can return home as often as you like. However, the insurer won’t cover you while you’re in your home country.

- Medical expenses over £500 are paid directly. Lower amounts must be paid out of pocket and then claimed back.

- Adding USA and Canada coverage is cheap. On an annual contract, the add-on costs around $90.

- 97% of Trustpilot reviews rate the insurer as excellent.

What to watch out for:

- Add-ons cost a lot. Extending an annual policy (costing around $500) by just one week costs an incredible $50.

- If there’s a contracted public hospital or doctor nearby, they won’t cover treatment at a private facility.

- High excess. When ordering, tick the option for zero excess. It’ll cost you roughly $50 per year and pays for itself with even a single claim. The default excess ranges from $42 to $150 per event.

- Working abroad isn’t covered by default. You’ll need to purchase the Adventure Pack add-on, which covers manual labour and volunteering.

World Nomads

For the more conservative travellers, World Nomads is still on the market – an insurer with a long track record. Their main selling point is the ability to purchase insurance even when you’re already travelling. How innovative! Today, almost every competitor offers this too, so you can certainly do better.

This insurer is quite expensive and has different terms (and prices) for each country, but they still maintain their client base, largely thanks to their reputation and excellent extreme sports coverage in the most expensive package. That’s why it’s insurance for adrenaline junkies and extreme athletes who need a no-compromise service.

Advantages of World Nomads

- They can pay hospitals directly, but it doesn’t always get arranged in time. In that case, you’ll have to pay out of pocket and wait 3–6 weeks for reimbursement.

- Excellent extreme sports coverage in the most expensive package.

What to watch out for:

- World Nomads works with multiple underwriters, so every policyholder has different terms (depending on their home country). Prices, conditions, limits, and benefits all vary.

- Policy extensions are expensive. One extra week beyond your contracted period costs around $80.

- You’re only allowed to return home once during your trip. Nomads who frequently return home will need to buy shorter policies at higher prices.

TIP: Travel insurance is definitely worth it because you never know what might happen, so don’t forget about it when planning your trip.

Frequently asked questions (FAQ)

Do airlines provide compensation for lost or delayed luggage?

Yes. Every airline handles it slightly differently, but in principle, if your luggage is delayed, they’ll reimburse the costs you had to incur because you didn’t have your belongings (toothbrush, clean shirt, etc.). They can also compensate for damaged or even lost luggage. You can find more about your rights under the Montreal Convention and EU regulations here.

Why do I need to fill in my home country when buying insurance? I’m a digital nomad and don’t live anywhere.

Because insurers need to know where to evacuate you if you’re seriously injured or need long-term care. For most people, this will be their country of citizenship – where you have family, access to healthcare, and don’t need a visa to enter. Note that some insurers don’t explicitly require you to be a resident of that country.

When should I buy insurance? Should I wait until departure day, or even until I’m already travelling?

The sooner you buy your insurance, the better. You should head to the airport or border with an active policy already in place. Terms vary by insurer, but coverage often doesn’t kick in until at least 4 hours after purchase. If you buy insurance at the airport, there’s a risk the insurer won’t cover a delayed flight.

How to choose travel insurance suitable for a visa application?

Some countries require proof of paid travel insurance before they’ll let you in. Examples include Schengen area countries (for non-EU citizens), the USA, and Canada. Always check the specific requirements of the country you’re visiting, but the insurers mentioned in this article should be accepted worldwide.

Can you compare long-term travel insurance plans anywhere?

Yes! For UK-based travellers, comparison sites like Compare the Market or GoCompare let you compare travel insurance policies side by side. However, for specialist long-term and nomad insurance like the ones we recommend here, you’ll often need to compare them manually.

Tips to make your travels easier

- Regularly scan all documents you collect on the road. Especially medical records, receipts for clothing, electronics, expensive items, and travel gear. Keep documentation for everything you buy and pack into your luggage, and scan all receipts immediately after your luggage is delayed. Store everything in cloud storage.

- Keep all travel documents in digital form. Especially your passport, driving licence, visas, and passport entry stamps.

- Travel with payment cards that are designed for travellers. Leave a backup card with a family member and just write down its numbers. It could come in handy for online payments if your wallet gets stolen.

- Always carry a physical copy of your insurance contract and passport on your person at all times. If you have an accident, first responders need to be able to identify you without your help (e.g., if you’re unconscious).

- Check what global emergencies your insurance covers. For example, during the coronavirus pandemic, you only had 10 days to leave countries for which the US CDC issued a Warning Level 3. Within a week, that essentially covered all of Europe. If you stayed in affected countries, any claims related to COVID (hospitalisation, cancelled flights, etc.) were not covered.

How to find cheap flights: 15 proven and lesser-known tips

How to find cheap accommodation

Tips and Tricks for Your Vacation

Don’t Overpay for Flights

Search for flights on Kayak. It’s our favorite search engine because it scans the websites of all airlines and always finds the cheapest connection.

Book Your Accommodation Smartly

The best experiences we’ve had when looking for accommodation (from Alaska to Morocco) are with Booking.com, where hotels, apartments, and entire houses are usually the cheapest and most widely available.

Don’t Forget Travel Insurance

Good travel insurance will protect you against illness, accidents, theft, or flight cancellations. We’ve had a few hospital visits abroad, so we know how important it is to have proper insurance arranged.

Where we insure ourselves: SafetyWing (best for everyone) and TrueTraveller (for extra-long trips).

Why don’t we recommend any Czech insurance company? Because they have too many restrictions. They set limits on the number of days abroad, travel insurance via a credit card often requires you to pay medical expenses only with that card, and they frequently limit the number of returns to the Czech Republic.

Find the Best Experiences

Get Your Guide is a huge online marketplace where you can book guided walks, trips, skip-the-line tickets, tours, and much more. We always find some extra fun there!